The effectiveness of the Gold IRA is determined by assessing the value on the gold held while in the account as a professional retirement financial commitment.

With IRA-approved bullion and coins, investors can diversify their holdings whilst securing their monetary foreseeable future.

What sets Provident Metals apart is their commitment to ensuring consumer pleasure. Good client opinions talk to the good ordeals and significant degree of services that prospects have gained.

Prospects might have assurance understanding that their delicate facts is safeguarded through the entire getting method.

When choosing the asset goods for your precious metals IRA, talk to an advisor affiliated with your business of preference.

With their target buyer fulfillment and commitment to giving a beneficial financial commitment expertise, investors can confidently look at American Hartford Gold for their valuable metals investments.

Speak to Details for Even more Inquiries: In case you have any thoughts or demand more details, make sure you Get in touch with us in the channels provided on our Site. We strongly advise consulting with a certified Qualified for customized tips.

American Hartford Gold presents investors the opportunity to diversify their retirement discounts via gold IRAs. That has a gold IRA, individuals can invest in Bodily gold and silver coins or bars in just a self-directed unique retirement account.

Initial-calendar year charge waiver: The corporate waives costs for the primary 12 months, making it possible for you to save lots of on initial prices when creating your click here gold IRA.

Legal and Monetary Information Disclaimer: The written content readily available on this Web page will not represent Skilled authorized or financial advice. Prior to making any authorized or economical choices, it is crucial to refer to with an experienced legal professional or fiscal advisor.

Investments in Gold IRAs need to adhere to purity benchmarks and so are topic to IRS regulations, with certain contribution limitations and rules for storage; the position of a custodian is crucial to handle these accounts and be certain compliance.

American Hartford Gold is often a trustworthy title within the market, specializing in supporting folks and family members make gold investments.

Some professionals of Patriot Gold Team consist of the ability to pick out your own custodian and superb customer care. A potential disadvantage is the upper minimum amount deposit need.

By deferring taxes on the gains until finally withdrawals are created in the course of retirement, investors can potentially experience sizeable financial savings after some time in comparison to taxable investment accounts.

Romeo Miller Then & Now!

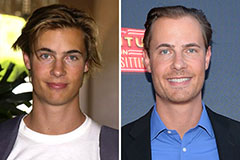

Romeo Miller Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Nancy McKeon Then & Now!

Nancy McKeon Then & Now! Jane Carrey Then & Now!

Jane Carrey Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now!